Vauxhall could close more than 100 UK dealerships amid falling car sales

Company is renegotiating franchise agreements with dealerships in bid to improve profits

Vauxhall will cut back its dealership network amid

Company is renegotiating franchise agreements with dealerships in bid to improve profits

Vauxhall will cut back its dealership network amid

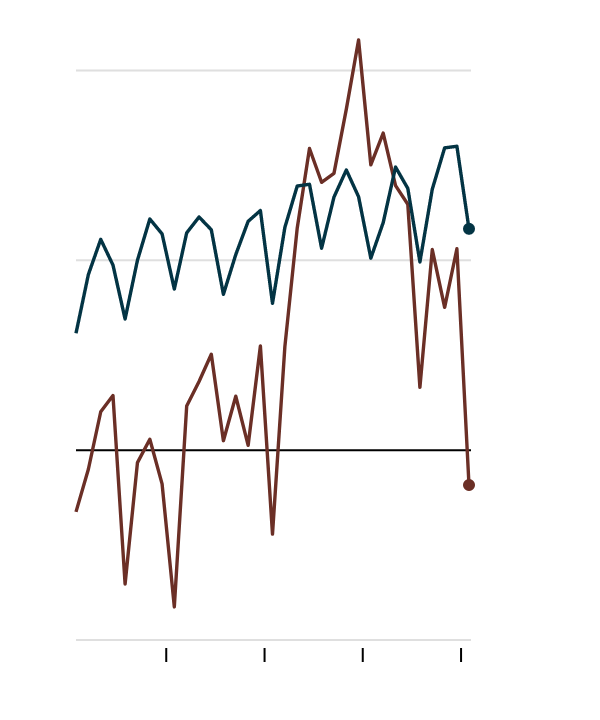

Wages grew faster than inflation for the first time in almost a year in February and the jobless rate fell to

Strong pound pushed FTSE 100 down on Tuesday morning

The pound hit its highest level against the dollar since the

Retailer chasing further growth with recent acquisition of leading US brand

JD Sports shares rose more than 6 per cent

Group plans to open nine new Primark stores across the globe in second half of the year

Associated British Foods

China’s Economy Grows, and Its Trade Gap With the U.S. Widens SHANGHAI — China’s economy grew at a healthy pace in

Senate Bill to Curtail Labor Rights on Tribal Land Falls Short Photo The Foxwoods Resort Casino in Connecticut, where a labor

According to the Resolution Foundation, if the decline in the UK home ownership rate continues, a third of people currently in

All UK locations on list dropped down the rankings, with Aberdeen seeing a particularly marked fall, while Monaco, Basel and Paris

Republicans hoped to make their $1.5 trillion overhaul the centerpiece of the 2018 midterm elections. But Americans, including President Trump, have

Never miss any important news. Subscribe to our newsletter.

Never miss any important news. Subscribe to our newsletter.

Copyright 2024 Radiobiafra. All rights reserved.