Around £40 of direct debit spending each montih is for products or services we have either forgotten about or never use

The average Briton will waste more than £30,000 in their lifetime after losing track of monthly direct debits.

Researchers found the typical adult pays out just over £111 in direct debits every month.

But around £40 of that is for products or services we have either forgotten about, or never use.

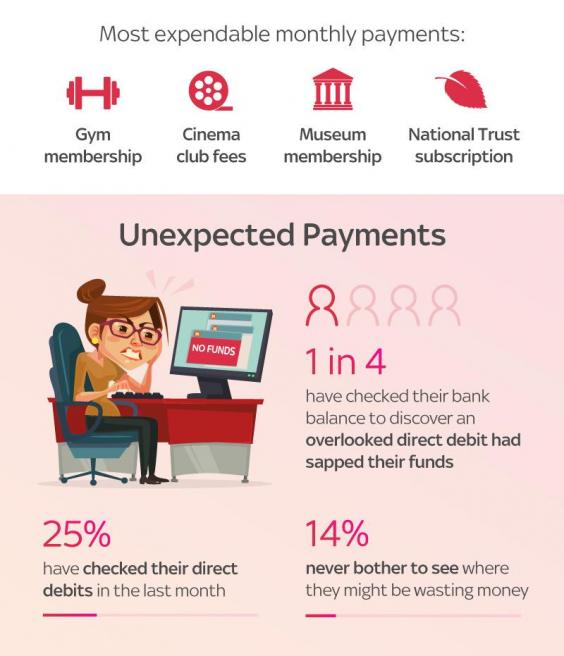

Of the monthly outgoings we regularly find ourselves paying for, gym memberships were deemed "most expendable".

Museum memberships, subscription to the National Trust and Cinema club fees were all also considered direct debits we’d cancel if we could be bothered.

The shocking figures emerged following a study by Sky Mobile which was launched after discovering their UK consumers were wasting an estimated £2bn a year paying for data on their phone tariff they didn’t use by the end of each month.

Sophia Ahmad, director of Sky Mobile said: “It’s important to keep an eye on payments which may unnecessarily drain our funds.

“To ensure customers don’t waste money paying for data they don’t use, Sky Mobile launched Roll, which automatically rolls over any unused data into their Sky Piggybank every month.

“Here, the unused data is saved for up to three years to use whenever it is needed, so there’s never any need to feel your mobile deal isn’t going as far as it should.”

The study also found one in four Brits have experienced a nasty surprise when they checked their bank balance and discovered an overlooked monthly payment had reduced their balance.

And while one quarter of those surveyed have checked their direct debit payments in the last month, one in seven have never stopped to take stock to see where they might be wasting money.

Of those surveyed, one in two said they found it a struggle to make their wages last until pay day, and one in four found it tough to keep track of spending.

Of those who have to stretch every penny to make it through the month, 74 per cent think their situation could be improved by managing their direct debit payments better in a bid to stop wasting money.

Forty seven per cent said they would feel more inclined to sign up for a service if they were able to rollover unused parts of their deal into the following month to reduce wasted spends.

Of those currently paying a mobile phone tariff, three in five struggle to use up monthly minutes, texts and data, which then go to waste when the month ends.

And seven in 10 wish they could carry over this excess to be used in the next month of their contract.

A resounding 77 per cent of adults who are paying direct debits for services they don’t use are unsure why they continue to pay the fees month after month.

Six per cent admitted they just forget about certain expenditures, and eleven per cent hesitate to cancel just in case they decide to use the service one day in the future.

Despite this oversight, which costs an average of £39.89 a month or £478.68 every year, nine in 10 Brits do consider themselves “financially savvy”.

One in two consumers admitted trying their luck by signing up to a monthly subscription to take advantage of a free month or offer, only to cancel it before the first payment leaves their account.

But the trick rarely pays off, as half of them have found themselves caught out with an unexpected payment when they forget to cancel the subscription once the offer expired.

SWNS

- More about:

- Direct debit

- Sky Mobile

Reuse contentRead the Original Article

Reuse contentRead the Original Article